State Farm Insurance - Auto, Home, Renters, Life

Create an affordable price, just for you

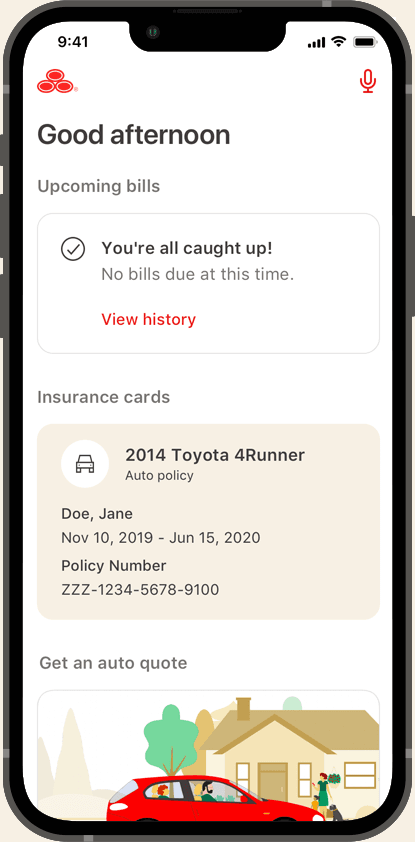

Introducing the State

Farm®

Personal Price Plan®

Start an insurance quote online.

No login required

Quick actions

Have questions? Call 800-STATEFARM 800-STATEFARM (800-782-8332)

Choose to personalize your bundle1 and save as much as $1,0732

Save money by combining the purchase of auto insurance with a homeowners, renters, condo or life insurance policy.3 When bundling, you have a choice to buy both products, either one or neither.

Our 19,000 insurance agents are ready to help you start bundling.

How can personalizing save me money?

When you personalize your insurance, you can get the protection you need and can afford.

Auto discounts & savings

See the options State Farm offers to help your budget

Save money with auto discounts

Talk to a State Farm agent about creating a Personal Price Plan to help you save money.

We’re hiring. Join a community of good neighbors

Find a job with our corporate teams or make the decision to become a State Farm independent contractor agent.

With you in mind

We’ve always taken a future-forward approach to developing products and solutions to meet your ever-changing needs. That’s truer today than ever before. Here’s how we’re there when you need us most.

Helping protect your business

Explore the wide range of products to help defend what you’ve worked so hard to build.

Banking on your time

Meet our third-party-provided products that allow you to bank when, where and how you want.

Planning for your future

Get a head start with mutual funds, annuities, educational savings and retirement planning.

Prices are based on rating plans that may vary by state. Coverage options are selected by the customer, and availability and eligibility may vary.

Deposit products offered by U.S. Bank National Association. Member FDIC.

Mortgage loans offered by Rocket Mortgage, LLC; NMLS #3030 www.NMLSConsumerAccess.org. Equal Housing Lender. Licensed in 50 states.

Neither State Farm nor its agents provide tax or legal advice.

Google Play and the Google Play logo are trademarks of Google LLC.

statefarm.com search results powered by Microsoft Bing (Microsoft Privacy Statement)